What's The State of Southeast Startups? This New Report Dives Into The Numbers

Want more tech stories in your inbox? Sign up for our newsletter to get the latest news from across the Southeast. Subscribe here.

Stability. Selectivity. Rigor.

That’s what defines the current state of startups building in the Southeast, according to a new report by Atlanta-based BIP Ventures.

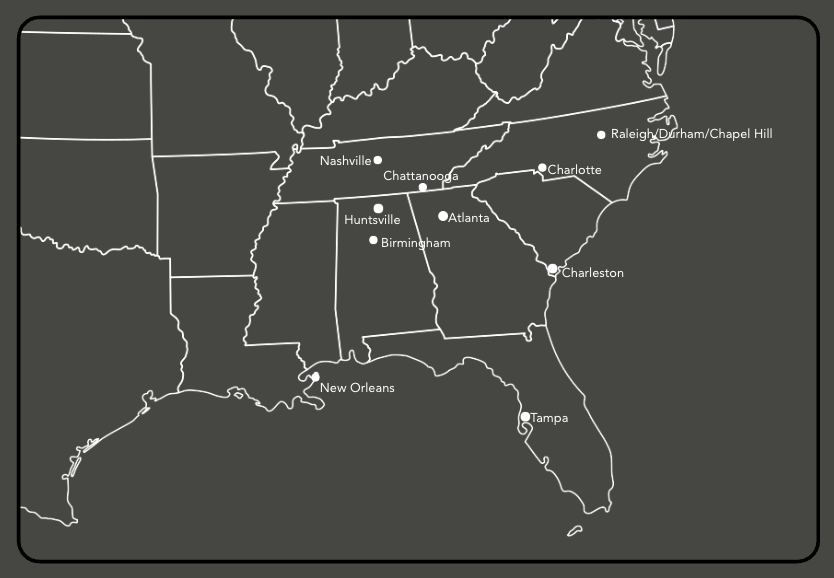

BIP's annual State Of Startups report, out today, explores how founders and funders alike are navigating the changing tech landscape. The report zooms into state-by-state deal opportunities as well as zooms out to look at how the Southeast compares to the rest of the national venture landscape.

Numbers To Note

$6.8 Millions

Average Check Size in the first half of 2025 in the Southeast, which is a 38% increase from 2024. That also represents a 45% increase since 2018.

What that means: The Southeast is seeing bigger checks. But those are being concentrated into few, and later, rounds.

$159.1 Millions

Post-Money average value of Southeast-based companies in the first half of 2025. That’s compared to $352.8 million across the country.

What the report says: “For investors, the Southeast is a measured and maturing market where valuations are climbing faster than dollars deployed – a sign that capital is concentrating in later-stage, fundamentals-driven companies.”

How Should Founders & Funders React?

Those numbers are certainly a “reset” from what we saw coming out of COVID, where capital in private markets was moving quickly across companies at all stages of growth.

Now, a move towards later-stage deals might raise alarm bells for founders looking to get first or early checks into their businesses.

Doesn’t change the business fundamentals, says Mark Flickinger, BIP’s General Partner and Chief Operating Officer.

“The core metrics of running a business never go out of style…what people are looking for is durability, defensibility, and that you're solving a known problem,” he told Hypepotamus.

As more VC dollars gets deployed into later rounds, Flickinger said that it creates a large open space for the next generation of investors looking to back the less competitive early-stage market.

“If you do your due diligence…and you are funding a known problem….that’s a great opportunity for a partnership to be formed.”

Comments ()