Atlanta Startup ‘Catch It’ Tackles Gen Z’s Peer-to-Peer Payment Chaos With Business-Ready Fintech

The team behind Atlanta-based Catch It is building a financial technology app with Gen Z entrepreneurs in mind.

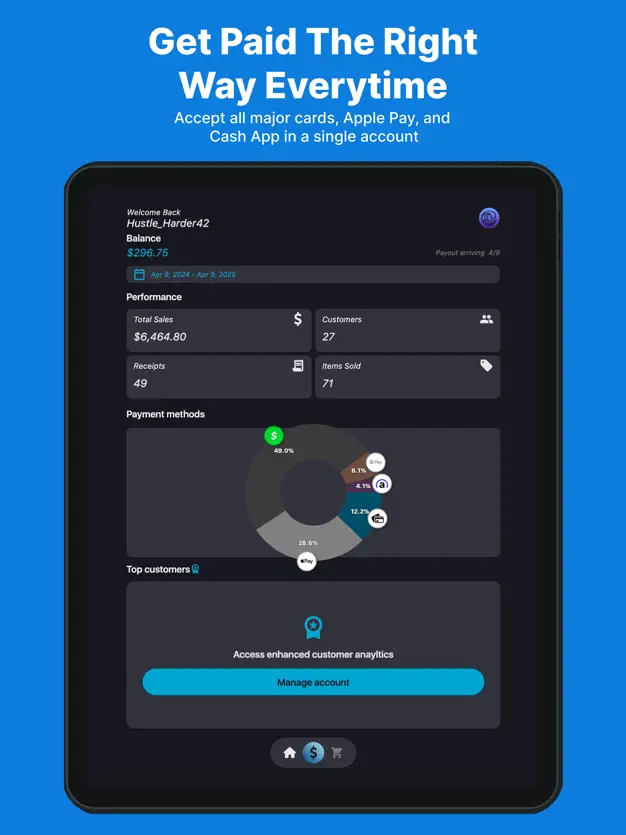

The startup, described as a “social commerce platform,” is designed to solve payment fragmentation woes occurring because young entrepreneurs and small business owners are more likely than not to use multiple peer-to-peer payment apps (like Cash, Venmo, or Zelle). While these platforms are convenient, they simply aren’t built for business transactions, making it difficult to keep up with financial statements and tax requirements.

Unlike Firmly (which builds enterprise-level checkout infrastructure) and Square (a point-of-sales giant), Catch It says its platform goes beyond just processing transactions. It also is built to update post-purchase engagement, social marketing loops, and financial documentation that business owners need to scale.

“What truly sets us apart is our user ownership model. Every piece of data on Catch It belongs to the seller. They can export it at any time for housing applications, income verification, and loan documents because we believe your hustle should count everywhere, not just on the app,” Austin Evans, founder and CEO, told Hypepotamus. “We're not just a payment processor; we're building the infrastructure for legitimacy, scale, and economic mobility.”

The platform currently has 42 paying sellers who are processing over $210,000 in transaction volume, the team told Hypepotamus. The platform runs on a 2% transaction fee on all payments processed through our platform. It is also working on a subscription model.

Solving An Entrepreneurial Problem

For Evans and the team, Catch It is about helping the next generation of entrepreneurs who are looking for more control and more options to connect with their customers.

“Right now, if your business runs on Zelle or Cash App, you don’t own your business, they do. One chargeback, one dispute, can literally shut their entire hustle down overnight. Millions of sellers risk their brands daily operating in payment chaos and it’s time we fix it,” Evans explained to Hypepotamus. Instead of bouncing between mobile payments apps and internally-built spreadsheets, business owners can use Catch It to access “verified merchant tools, performance data they can leverage for funding, and the ability to sell through a link or QR code with no coding or storefront required.”

“We’ve built the first system that lets everyday sellers operate like real businesses, without the friction,” Evans added. “One chargeback shouldn’t shut down your hustle. These new tools give sellers stability, visibility, and the infrastructure to grow whether you’re moving $5K or $500K a month.”

Meet The Catch It Team

Evans, who serves as Catch It’s founder and CEO, is building the startup alongside Shawn Filer (COO), Kris Diallo (CTO), Sencere Smith (CMO), and John Whatley (CPO).

Evans said he met Filer while the two were working on different startup companies.

“We’d link up at their house or work together at Atlanta Tech Village. Somehow, we always ended up being the last two still grinding late into the night. That’s where our trust was built on shared work ethic and real friendship. Even after he went off to Stanford for grad school, we stayed close. When Catch It became real, I knew he was the perfect person to help bring it to life. He’s been my right hand through this whole founder journey,” Evans added.

Diallo got connected to the team through Columbia University professor Dr. Jonathan Collins. Other members of the team joined in February.

“We’ve got a strong foundation, real alignment, and we’re locked in as we get ready to launch,” Evans added.

Building FinTech In Atlanta

The Catch It team is strategically building Catch It in Atlanta, aka Transaction Alley. The city got its nickname as it has served as the launching pad for fintech startups and corporate successes alike.

The team will launch the first public version of Catch It next month. The launch will come with expanded payment capabilities and “foundational partnerships with financial service providers."

Ultimately, the team sees Catch It growing into an agentic financial system, one where “the software doesn’t just track your business, it acts on your behalf.”

“We envision a future where every seller has a personal revenue agent: automating tasks, generating income proofs in real-time, qualifying them for credit or funding, and unlocking new forms of ownership based on their performance, not their paperwork,” the team added.

The startup was bootstrapped through its first year as it focused on research and development with creators, resellers, and business owners. After being accepted into the Alchemist Accelerator, the team closed a friends and family round.

Alongside its July launch, the Catch It team is gearing up to open its pre-seed round.

“July is just the beginning,” the team added.

-Featured photo from left to right (Shawn, Kris, Austin, Sencere)

Comments ()