Your Credit Score Doesn’t Tell the Whole Story — This Atlanta Startup Does

It’s time to go beyond the credit score, says the team behind RevelFT.

That’s because a consumer credit score, which is compiled by major bureaus like Equifax, Experian, and TransUnion, shows “past borrowing behavior, but not financial wellness,” says Co-Founder & CMO Jean-Albert Maisonneuve. That means credit scores don’t account for how much an individual is saving, whether they are meeting financial goals, and if they are financially able to keep up with whatever life throws at them.

RevelFT is bringing a new product, STANCE, to market as a more comprehensive financial health tool. Their platform fills in the gaps traditional scores leave behind.

STANCE helps users get a “full picture of their financial health — not just how they’ve spent money, but how today’s decisions shape their financial future,” Maisonneuve told Hypepotamus.

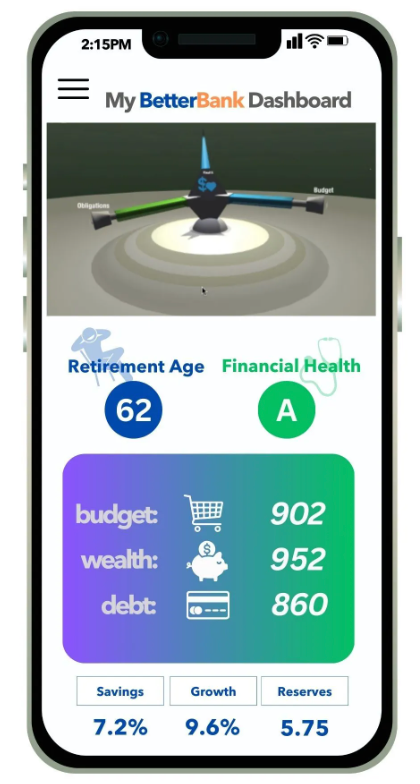

The platform provides users with a “Financial Health Score” that looks at cash flow, risk exposure, savings strength, and other predictive stress indicators. It connects securely to a user’s financial accounts (including bank accounts, credit cards, and loans) using trusted open banking technology without the need for credit checks or manual budgeting. The platform then provides tailored insights and runs “predictive what-if simulations” for those looking to better understand their finances.

It also uses goal-setting and interactive scenarios to guide users, giving them control of how to improve their financial future. The reward isn’t points or badges, it’s being able to see the impact of smarter decisions over time and feeling more in control of your future.

Unlike budgeting apps or credit-score tools, STANCE is predictive. We show how today’s choices shape future outcomes. Our Financial Health Score looks beyond spending to include savings, debt, and goals and gives users actionable, personalized recommendations, not just dashboards.

Financial institutions can also use STANCE as a tool to give customers more guidance about their money.

“In short, we turn fragmented financial data into an actionable, predictive roadmap,” Maisonneuve added.For example, a user comparing two car loans can use the platform to see how each option affects their cash flow, savings, and ability to reach goals like homeownership. It shows how today’s decision plays out over time, not just the monthly payment.

Meet The Team

The team operates primarily out of New Jersey, New York, and Georgia, with executives for the company Neeti Dewan and founder Reginald Maisonneuve located in Atlanta.

The team is in its early stages and is currently working on filling out its 500 person waitlist. To scale, Maisonneuve said the team is looking at strategic investments as well as “intros to fintech-forward institutions (credit unions, banks, employers) looking to embed next-generation financial wellness tools.”RevelFT, with its Stance platform, joins a cluster of Atlanta-based financial technology startups and companies that have a customer-facing tool. Others include Greenlight (giant investment platform for kids) Ditch (debt repayment platform), Catch It (peer-to-peer payments), Habits (a platform for finding financial advisors), and Instant Financial (early wage access).

Comments ()